Business Mileage Rate Is Up for 2025

Business Mileage Rate Is Up for 2025

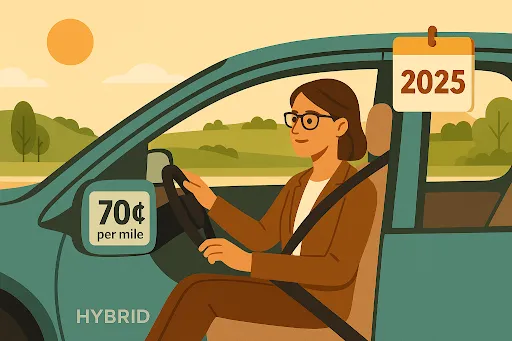

The IRS has issued the 2025 cents-per-mile rates that can be used to calculate tax-deductible vehicle operating costs. Effective Jan. 1, 2025, the standard mileage rate for the business use of a car, van, pickup truck or panel truck is 70 cents per mile. This is up from 67 cents per mile for 2024. (For medical or eligible moving purposes, the 2025 rate is 21 cents per mile, and for charitable driving, it’s 14 cents per mile, both unchanged from 2024.)

These rates apply to gasoline and diesel-powered vehicles and to electric and hybrid-electric automobiles. To protect your deduction, don’t forget to keep detailed mileage records. Contact the office with questions.